Research Papers

|

Persuasion for the Long-Run | with James Best

Forthcoming, Journal of Political Economy We examine persuasion when the sole source of credibility today is a desire to maintain a public record for accuracy. A long-run sender plays a cheap talk game with a sequence of short-run receivers, who observe some record of feedback about past accuracy. When all feedback is public (as standard in repeated games), persuasion frequently requires inefficient on-path punishment---even if accuracy is monitored perfectly. If instead the record publishes coarse summary statistics (as is common online), any communication equilibrium the sender prefers to one-shot cheap talk---including Bayesian persuasion---can be supported without cost. |

|

Inside and Outside Information | with Ansgar Walther

Forthcoming, Journal of Finance 2016 Econometric Society European Meeting Award We study an economy with financial frictions in which a regulator designs a test that reveals outside information about a firm’s quality to investors. The firm can also disclose verifiable inside information about its quality. We show that the regulator optimally aims for “public speech and private silence”, which is achieved with tests that give insiders an incentive to stay quiet. We fully characterize optimal tests by developing tools for Bayesian persuasion with incentive constraints, and use these results to derive novel guidance for the design of bank stress tests, as well as socially optimal corporate credit ratings. |

|

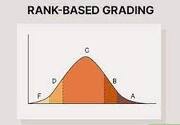

Conjugate Persuasion | with Ian Jewitt

We consider a class of persuasion games in which the sender has rank-dependent (Yaari (1987)) preferences. Like much of the recent Bayesian persuasion literature, we allow the sender to choose from a rich set of information structures and assume the receiver’s action depends only on her posterior expectation of a scalar state variable. Conjugate to the standard problem, our sender’s utility is linear in posterior the mean, but may be nonlinear in probabilities. We geometrically characterize the sender’s optimal commitment payoff and identify the corresponding optimal information structure. When the state is continuously distributed, communication takes a monotone partitional form. Our characterization admits a simple analysis of comparative statics—for instance, we find that ``grading on a curve'' is a feature of optimal design. Finally, we apply our analysis to several problems of economic interest including information design in auctions and elections, as well as the design of equilibrium insurance contracts in the face of the `favorite-longshot' bias. |

|

The roles of transparency in regime change | with Frederik Toscani

How does freedom of information about an institution's resilience affect its stability? We study the ex ante impact of public information on regime change in a global game, accounting for uncertainty over what will be communicated. A fundamental tension exists in the ways public information impacts coordination. When the probability of regime change is already high, public information persuades agents into larger attacks. But under these conditions information targets attacks wastefully. For `small' releases of public information, we characterize the overall implications of this trade-off for regime change. When the incumbent is ex ante weak, public information persuades agents to attack while simultaneously reducing their chances of success. By contrast, lower costs imply transparency negatively affects regime change only if the marginal productivity of attacks is sufficiently high. |

Projects in Progress

History Design | with James Best

Community Rating and Monopoly Screening | with Andre Veiga

History, Efficiency, and Implementation: Theory and Experiment | with James Best and Peiran Jiao

Transparency in Global Games of Regime Change | with Toni Ahnert, Christoph Bertsch and Frederik Toscani